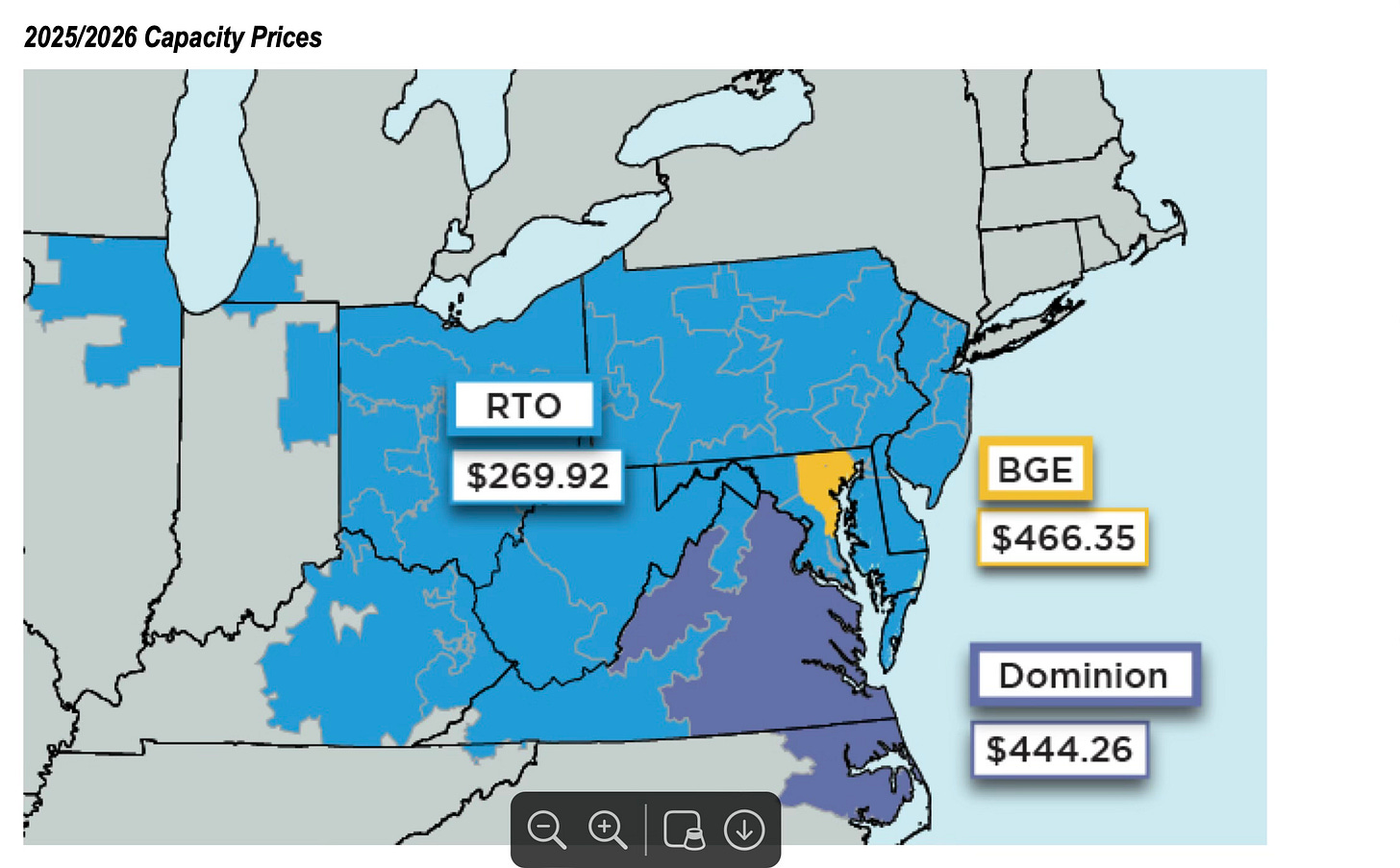

Graphic from PJM Auction Report

PJM Capacity Markets

Capacity payments at PJM rose roughly tenfold.

The capacity market clearing price at PJM went from $28.92/MW-day for the 2024-2025 auction to $269.92/MW-day for the 20205-2026 auctions.

But two PJM regions saw even higher increases rises, with capacity clearing prices above $440 dollars.

• The Baltimore Gas and Electric Zone reached its price cap of $466.35/MW-day

• The Dominion area reached its price cap of $444.26/ MW-day

As Ethan Howland reports in Utility Dive “The auction’s total cost to consumers jumped to $14.7 billion from $2.2 billion in the last auction.” How will this affect consumers is not entirely clear. As Howland reports: “Last year, capacity costs accounted for roughly 8% of customer electric bills..” according to Stu Bresler, PJM vice president for market services and strategy. (Emphasis added.)

I am sure there will soon be many articles about this price rise, and the articles will illuminate many aspects of the situation. However, I want to describe the situation as I see it right now, in a simple (perhaps oversimple) manner.

The Two Grids

In Shorting the Grid, I describe the grid as consisting of two grids: the power grid and the policy grid. The power grid consists of generators, substations, wire and dispatch centers. The policy grid is the rules, regulations, payments for generators, subsidies and so forth.

The physical grid is ultimately ruled by physical laws, while the policy grid is ruled by laws, regulations and subsidies.

On most RTO-type grids, there are two main auction markets in the policy grid.

• The Energy Market pays a generator for the kWh that the generator puts on the grid. These payments are usually recalculated every few minutes or every half-hour.

• The Capacity Market pays a generator for being available to the grid. The payments are arranged years in advance and are calculated in terms of MW-Days.

I start my explanations by looking at the physical grid. Most people can see parts of their physical grid by looking out the window, so that is a realistic place to start.

The Physical Grid at PJM

Why did the capacity price rise so high in PJM? The physical grid offers a simple explanation. Supply and demand.

The capacity market pays for installed capacity (plants that can come online). Installed capacity (supply) is shrinking while demand is growing. Therefore, prices will rise.

• Demand is growing partially because of “electrify everything.”

• Supply is shrinking due to retirement of fossil-fired plants. For example, the large gas-fired plant, Mystic Generating Station, produced about 2000 MW. It was retired on June 1, 2024.

• There are also problems with connecting new renewable plants. So renewable capacity is not growing as fast as people had hoped.

Which means that, without noticing it, we are have now begun to discuss the Policy Grid.

The Policy Grid at PJM

The policy grid is the rules and laws and subsidies and payments on the grid.

In PJM, the policy grid has such an interconnected set of new and confusing situations that I am just going to list some bullet points. I leave it to later commentators to attempt to tie all these issues together. I’m numbering the bullet points because there are so many of them.

1) Transmission: Difficulties with getting permissions and arranging financing for new transmission lines.

2) Low Energy Prices: Energy prices in PJM have fallen through the floor.

As a press release from the PJM Market Monitor states: “Energy prices decreased significantly in 2023 from 2022. The real-time load-weighted average LMP in 2023 decreased 61.2 percent from 2022, from $80.14 per MWh to $31.08 per MWh. This was the largest annual price decrease ($49.06 per MWh) and the largest annual percent price decrease (61.2 percent) since the creation of PJM markets in 1999.” (emphasis added)

In my opinion, part of this price reduction was due to less expensive gas prices, but some of it was due to the bids of subsidized renewables. Subsidized renewables can often bid zero to the energy auctions. In other words, they live on the subsidy and the grid doesn’t have to pay them for their kWh energy. This can lower the clearing price for all the plants in the energy auction.

3) Revenue requirements: Power plants need to make a living.

If their energy payments sink, they will try to make this up by bidding in higher to the capacity market. (My opinion. I expect some comments with more detailed information and some other comments with uninformed pushback. I’m ready for either.)

4) Capacity Auction Delays: PJM has been haggling about its capacity auctions for months.

The recent capacity auction was supposed to be held in May. However, it was delayed due to court cases. May to July is not the biggest delay PJM capacity auctions have faced.

As Utility Dive wrote in 2023:

“(PJM) has been holding the auctions under a compressed schedule to return to its once-a-year process because of a roughly three-year delay caused by FERC’s June 2018 decision finding that PJM’s minimum offer price rule (MOPR) unfairly suppressed capacity prices.” (emphasis added)

5) MOPR: Minimum Offer Price Rule:

So now I need to talk about the MOPR rule. MOPR does not allow subsidized resources (think renewables and sometimes nuclear) to consider their subsidies in their capacity bids. MOPR meant that renewables and nuclear had to bid higher and might not clear the auctions. If you notice in the July article in Utility Dive about high capacity prices, gas-fired generation was 48% of cleared capacity, nuclear was 18% of cleared capacity. Solar and wind didn’t do so well. They were each 1% of cleared capacity.

6) Market reforms at PJM. For months now, PJM has attempting to change market accreditation.

What is market accreditation? It is how many MW that a plant is allowed to bid into the capacity market. Plants rarely choose to bid into the capacity market at their nameplate value, because such a bid would imply that they never go offline. But problems arise when renewables bid in at too high a capacity value. (This could be an entire book on its own.)

In February of this year, FERC accepted PJM’s proposed new rules for the capacity auctions. PJM Capacity Market Reforms Shake Up Resource Accreditation, Impose New Offer and Testing Requirements. (Article by Maxwell Multer at Power Magazine.) Briefly speaking, PJM will now use ELCC (Effective Load Carrying Capability) for capacity bids for all generation resources. ELCC is the MW of a generation unit which is available when needed, particularly when the grid is stressed. This change will be fine for nuclear but will be a problem for weather-dependent resources.

Wild and Wooly

So, here we are. Thermal power plants are retiring. Auctions have been delayed, there are new rules against MOPR, lowered energy prices have been accompanied by increased capacity prices, and there are new rules about capacity accreditation. In other words, pretty much everything is changing on the PJM physical and policy grids.

Right now, I suspect the people with the deepest knowledge of this type of situation, and with the most intense desire to figure it out….are the energy traders.

I am not an energy trader. I have explained the situation as far as I understand it. All I know is that electricity bills in PJM are going to rise.

I hope for many comments on this post.

Zinger:

A few hours ago, this article by Ethan Howard appeared in Utility Dive. PJM capacity auction to lead to double-digit rate hikes for Exelon utilities: CFO

As Bette Davis said, Fasten your seat belts. It’s going to be a bumpy night.

I read your book. I read your Substack posts. I’m always amazed at the complexity of the policy grid. It all seems beyond human understanding. How can anything so complicated be expected work well? As an engineer, “Keep it simple stupid” always had great appeal. Obviously, the designers of the policy grad never, ever heard of KISS.

In 2020 one of the weather dependent energy loving climate alarmists proposed a taxpayer purchase & retirement of coal fired power stations. The proposal stipulated the revenue would come from "subsidies" paid to the coal plants.

The theory was that this was supposed to accelerate the rollout of wind & solar.

The fine print explained (without irony) that the supposed subsidies were in fact the capacity payments. There was no discussion of why intermittent power systems were generally ineligible for the "subsidies" that guarantee delivery on demand.