This Week, Grid Operators Braced For Impact

PJM bails out MISO, SPP Declares an Energy Emergency Alert

Grid conditions were tight this week as 90-degree temperatures enveloped much of the Midwest and Mid-Atlantic regions. As a result, the Midcontinent Independent Systems Operator (MISO) issued a Maximum Generation (Max Gen) Warning, PJM issued a Max Gen Alert, and Southwest Power Pool (SPP) issued an Energy Emergency Alert 1 (EEA1).

During Max Gen Warnings and Alerts, grid operators warn power plant operators that electricity supplies on the grid are getting tight and instruct generation owners to take steps to ready their fleets to meet the moment. During an EEA1, all non-firm exports are curtailed, and all available resources are committed to meet demand.

Apparently, the wind turbines in MISO didn’t get the memo, leaving the system operator scrambling for imports from neighboring regions.

Thankfully, the natural gas distribution system is less stressed in the summer due to lower demand and warmer temperatures, allowing gas generation to increase during this period. However, two of the three pillars of

’s “fatal trifecta” —overreliance on renewables and imports—were on display.MISO

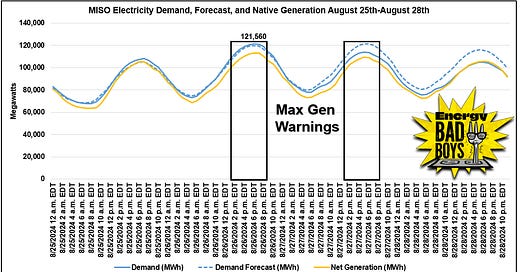

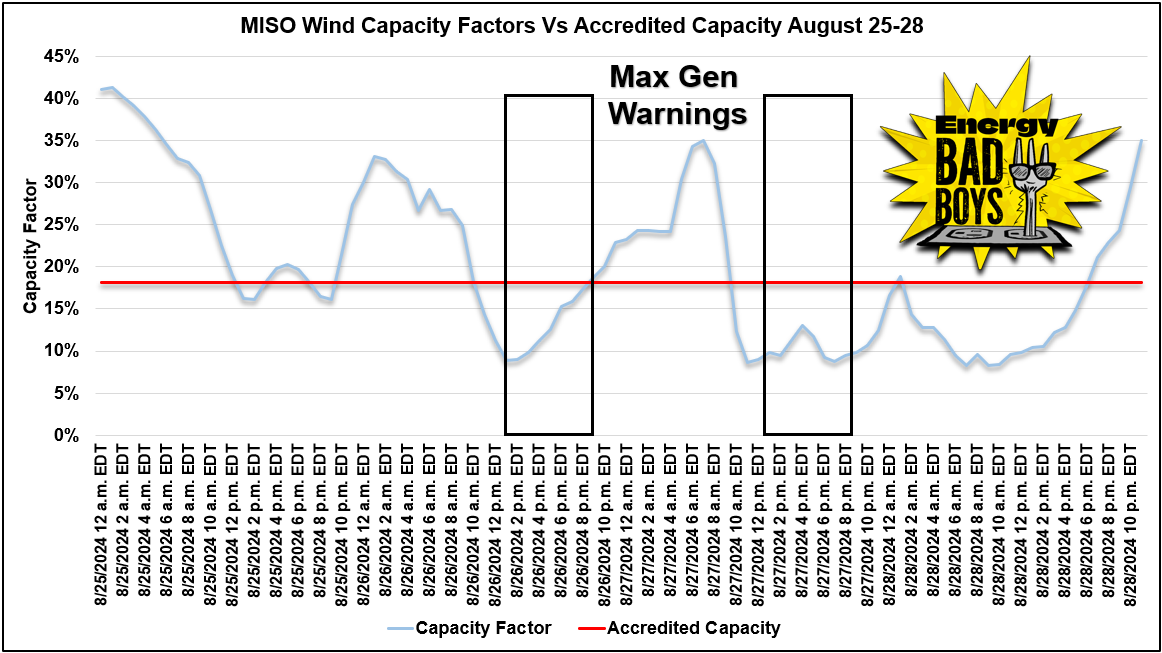

MISO declared Max Gen Warnings in its North and Central regions for August 26th and 27th from 1 pm to 8 pm on both days due to forced generation outages, above-normal temperatures, and limited transfer capabilities.

Electricity demand peaked on the 26th at 121,560 megawatts (MW), slightly outstripping the forecast. The yellow line in the graph below shows MISO’s native generation. It was below the blue line, meaning MISO was a net importer during this time.

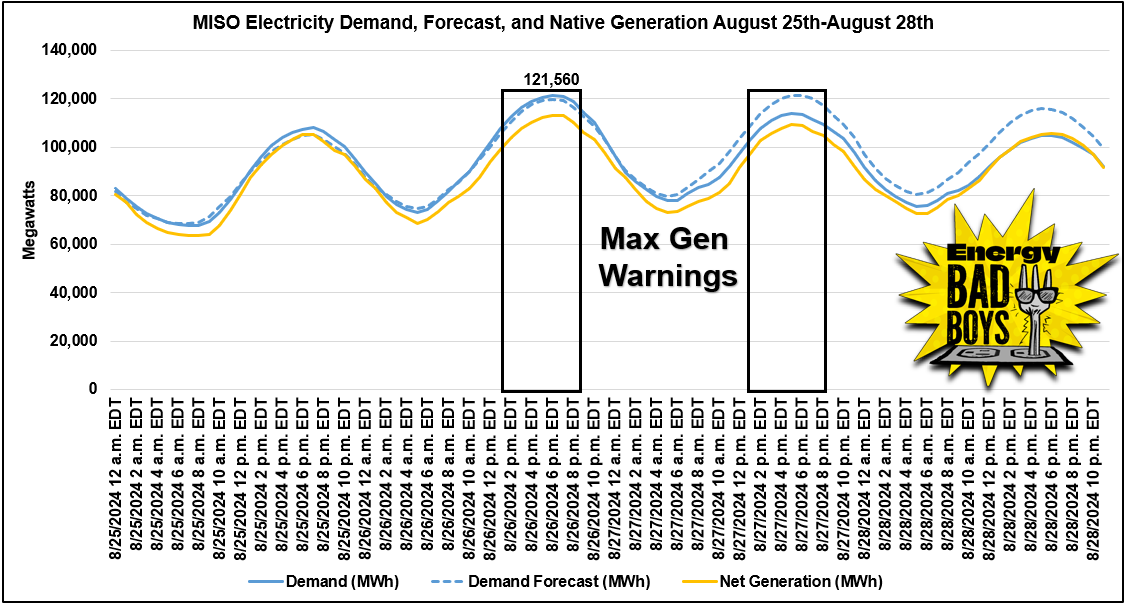

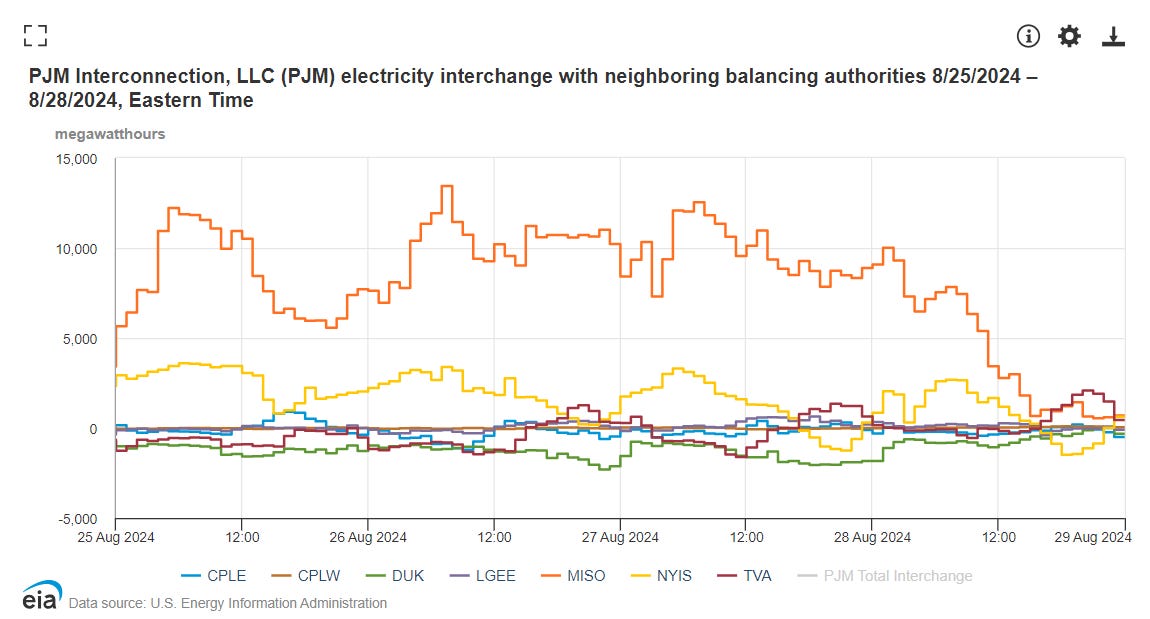

The imports were coming primarily from PJM, with Manitoba Hydro also sending significant quantities of power during the Max Gen warnings. The graph below shows net interchanges, so negative numbers indicate imports, and positive numbers indicate exports. The data are from the U.S. Energy Information Administration’s Hourly Data Browser.

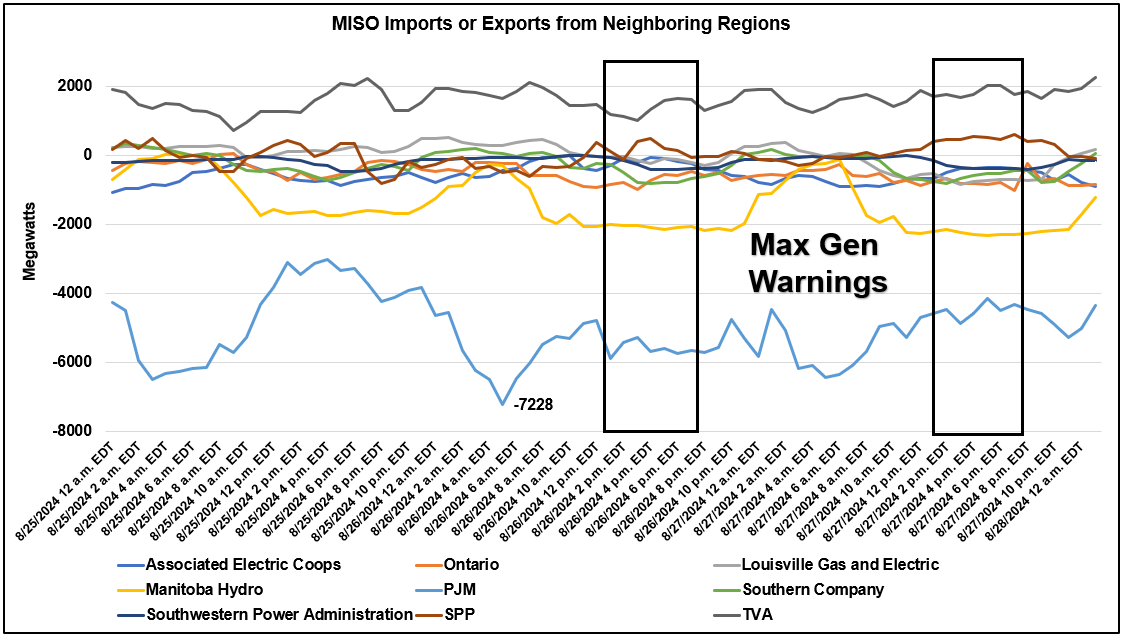

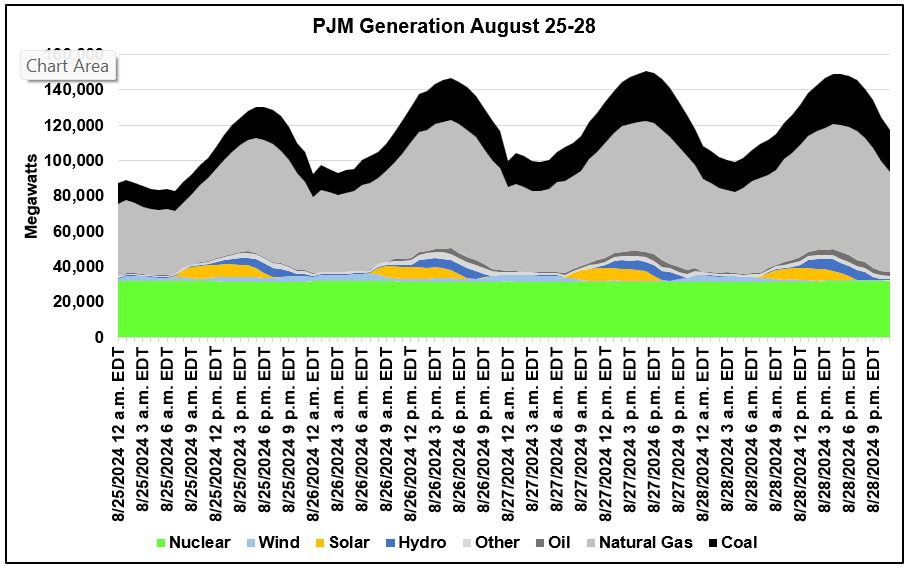

The graph below shows that natural gas and coal provided the lion’s share of electricity during the Max Gen Warnings, with solar production increasing as the wind died down. We also added imports to this graph to show the full resource portfolio during the periods of stress.

MISO’s wind fleet was lackluster during the Max Gen Warnings, operating below its accredited capacity of an 18.1 percent capacity factor during the duration of the two events, in some hours as low as half of its accredited capacity.

The low wind output meant the resource did very little to keep the lights on in the MISO region, and highlights why relying on capacity values - which designate how much capacity system operators can depend on to meet peak demand - for intermittent generators to meet resource adequacy is a huge gamble in terms of reliability.

Realistically, wind and solar contribute very little to system reliability, as MISO's latest Max Gen Warning shows, and their capacity values should be more in line with these expectations.

PJM

PJM’s current role in the Eastern Interconnect is obviously to serve its customers, but it also serves as an exporter to MISO and other neighboring regions when supplies get tight.

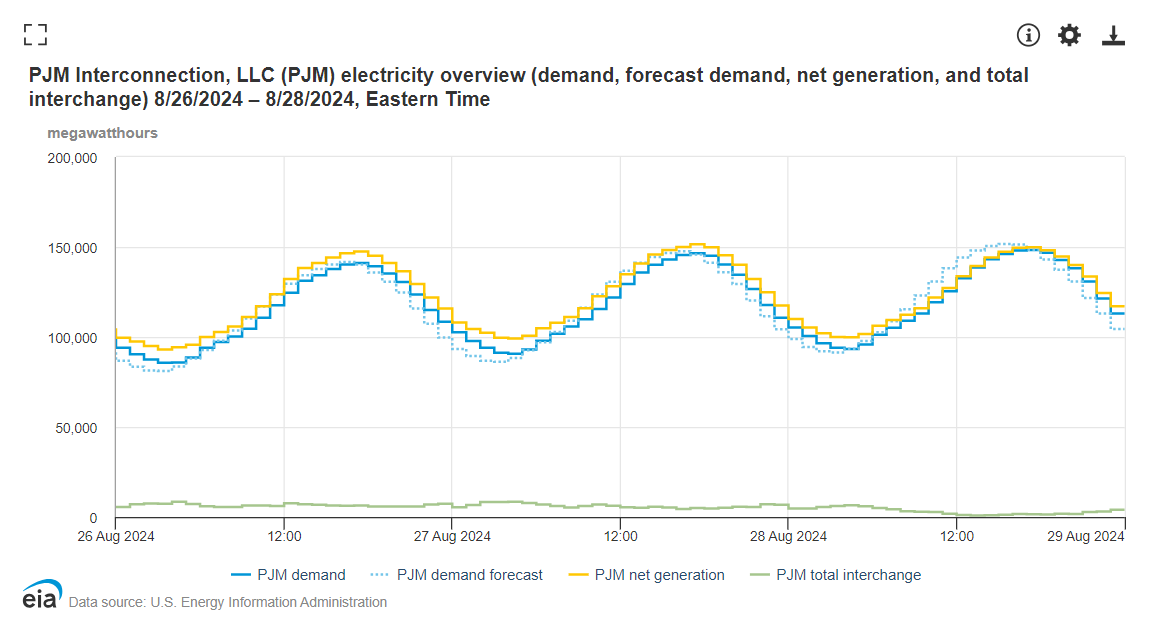

On August 27th, PJM declared a Max Gen alert as demand hit 146,574 MW. PJM’s website doesn’t indicate when the Max Gen was declared, but it ended at 7:30 pm on Tuesday.

Unlike MISO, PJM issued the Maximum Generation Alert as a precaution due to a high load forecast and an increased amount of electricity being exported to neighboring regions.

PJM’s data suggest exports to MISO were even higher than the figures that MISO reported to EIA. We are not sure why there is such a large discrepancy, but the ability of MISO to import from PJM was clearly a major factor allowing them to keep the lights on this week.

These exports were possible because PJM has large nuclear and natural gas fleets, and coal still provides a meaningful supply. Thus far, PJM does not have much in the way of wind or solar, but solar contributed about 7,000 MW at its peak output during this period and wind contributed about 700 MW.

While PJM helped save MISO’s bacon this week, this may not always be the case. PJM issued the Tweet below indicating it may need to curtail non-firm exports if its own internal demand is not being met.

This led one Twitter user to drop this meme.

This suggests that the strategy laid out by many utility, state, and federal proposals to rely on imports from the markets when wind and solar prove insufficient is already running on thin margins - and this is only the adolescent phase of the “energy transition.”

SPP

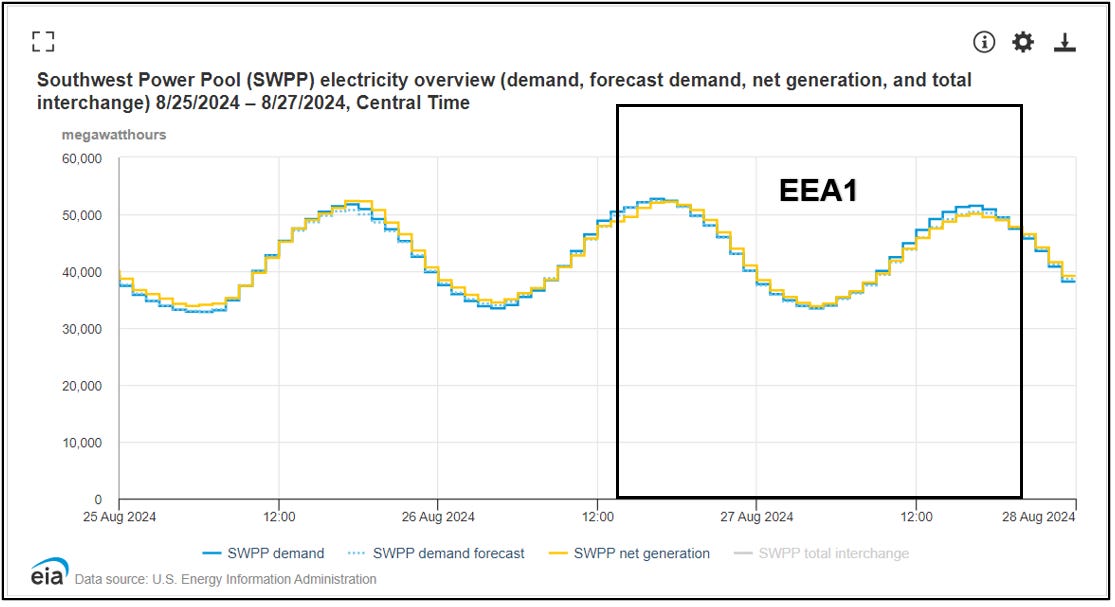

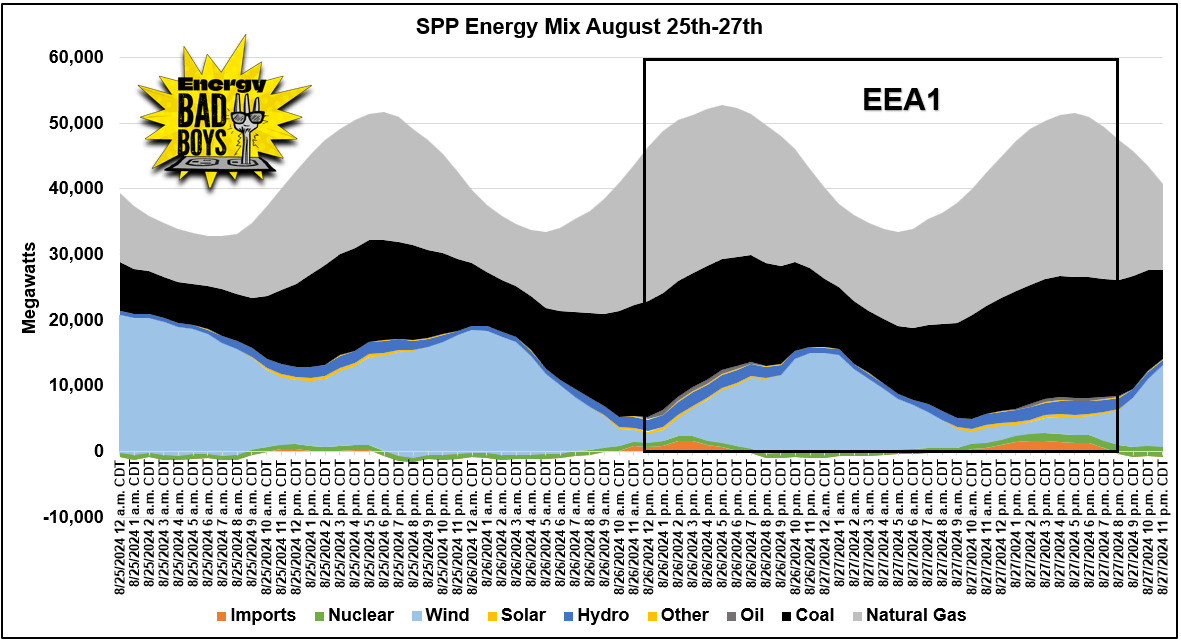

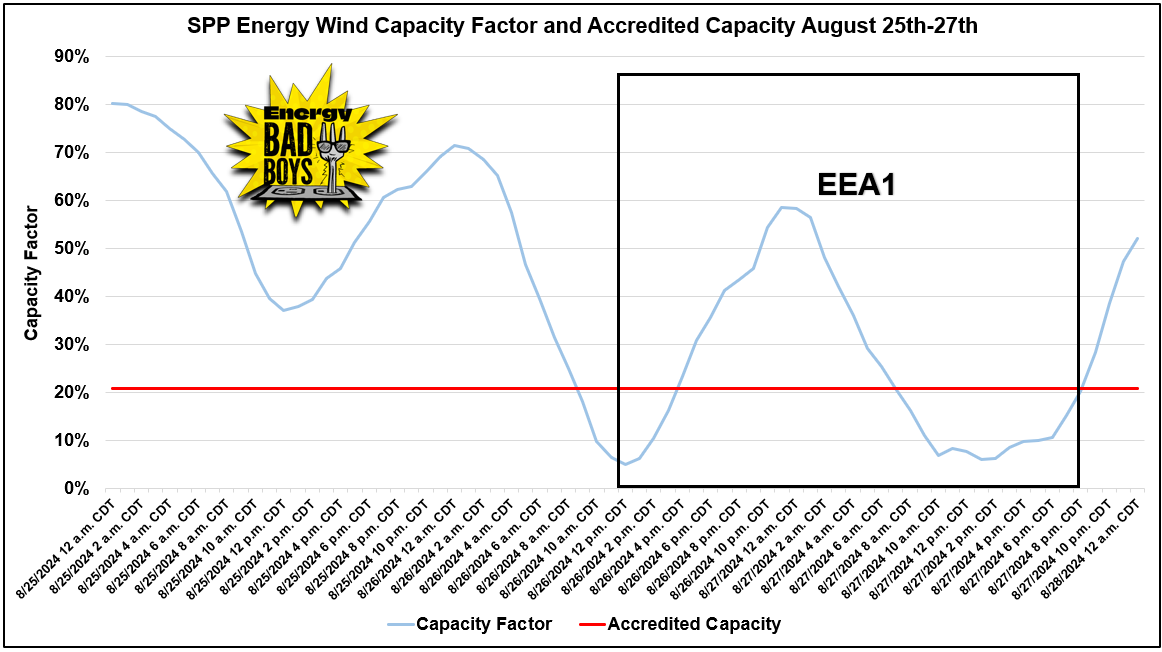

SPP declared an EEA 1 for 12:30 pm on August 26th and ended it at 8:15 pm on August 27th. From SPP’s declaration:

“The EEA1 is being declared based on forecasts of high peak loads due to widespread high temperatures, an increase in resource outages and low output fromwind and other variable energy resources… leading into peak hours.”

Electricity demand peaked on the 26th at 52,702 MW, outstripping the demand forecast by about 300 MW. The yellow line in the graph below shows SPP’s native generation. At times, it was above the blue line, meaning SPP deviated between being a net importer and exporter during this time.

SPP’s natural gas fleet increased output during the EEA, as did the coal fleet. Wind generation had mixed results. Similar to MISO, SPP wind resources were generating a lot when demand was low, and little when demand was high.

During the EEA, wind generation fluctuated from as little as seven percent of its installed capacity to as high as nearly 60 percent. However, the periods when wind generation was highest occurred when demand had fallen, and it dipped back down when demand increased once again.

This behavior is normal for wind turbines, and it didn’t help SPP much in the way of meeting peak demand on the 27th. For reference, SPP gives wind turbines an accreditation of 21 percent, meaning wind was producing less than half of its accredited capacity used in resource adequacy models during peak demand.

Conclusion- Living in the Future

MISO, PJM, and SPP were able to survive the week without rolling blackouts, and this is largely due to the coal and natural gas plants operating on their systems. These assets are in the crosshairs of both state and federal energy policies. If these policies force these reliable generators off the grid in favor of wind and solar, then similar (or even less severe) conditions in the coming years could yield drastically different results.

Until then, we’re just living in the future, waiting for our date with destiny.

Hit like, share, and subscribe if you like John Prine.

Hit unsubscribe if you don’t like John Prine.

‘Energy Bad Boys’ analysts are exposing the impacts of green energy on reliability, affordability by

Kevin did a very nice write-up on Always On Energy Research. Thanks, Kevin!Barriers to Energy Supply Are Everywhere—Let’s Get Serious about Permitting Reform by

andBay Watch by